Re-mapping Default Financial Accounts

Mapping of Campspot's default financial accounts is required in order for a Journal Entry report to produce accurate financial data. The information in this article will empower you to re-map your accounts appropriately.

Getting Started: Re-Mapping Financial Accounts

Before initiating the re-mapping process, it's crucial to determine the accounting methodology employed by your park—whether it operates on a Cash Basis or an Accrual Basis. If unsure, consulting with the park owner or financial controller is recommended.

Learn more! For in-depth insights between these accounting styles, check out the resources below:

The re-mapping procedure for Campspot's default accounts remains largely consistent regardless of whether your park adopts Cash Basis or Accrual Basis accounting. Any disparities between the two will be highlighted later in this guide.

Please Note:

Creating custom financial accounts may be necessary to align with your park's Financial Reporting preferences. By creating custom accounts, you can tailor the Default Financial Accounts to suit your specific Financial Reporting requirements.

Before delving into the content of this article, we recommend reviewing the following resource to gain a deeper understanding of custom Financial Accounts:

Re-Mapping Step-by-Step

Financial accounts are mapped in different areas of Campspot. The remainder of this article is organized by setup area. To jump to a specific area, you can click on part below:

-

Campground Setup:

-

Rules:

-

Reporting:

Campground Setup:

Payment Methods

Change all Payment Methods mapping from General Liability to General Asset

-

- As a best practice we recommend creating additional Asset accounts labeled ‘Transfer Internal’ and ‘Transfer External’ and mapping those to the corresponding payment methods

- Unit Setup: Ensure the Main Financial account for all Site types and Add-on types is set to General Revenue. General Revenue is the default Main Financial Account for Site Types but it is recommended to double check in case these have been edited previously.

- As a best practice in Unit Setup, we recommend changing all the Deferred Financial Accounts to Deferred Revenue, however, this does not impact reporting unless you're using Accrual basis accounting

The clip below shows the mapping of one Site Type.

.gif?width=576&name=ezgif.com-gif-maker%20(16).gif)

Rules:

-

- All Reservation Surcharges (Rules > Pricing > Reservation surcharges): The Main Financial Account should be set to General Revenue, and the Deferred Financial Account should be Deferred Revenue.

- Site Lock Fees (Rules > Functions > Lock site function): The Main Financial Account should be set to General Revenue, and the Deferred Financial Account should be Deferred Revenue.

-

-

Taxes (Rules > Pricing > Taxes): Create a liability account for tax (typically named the same name as the tax) and map this newly created account as the Main Financial Account. The Deferred Financial Account should be General Liability.

- Cancellation Fees (Rules > Policies > Cancellation policy): The Main Financial Account should be set to General Revenue and the Deferred Financial Account should be set to Deferred Revenue.

-

The clip below shows the mapping of one Tax rule.

.gif?width=606&name=ezgif.com-gif-maker%20(18).gif)

Reporting:

-

System Accounts are mapped under the Accounting tab in Reporting.

-

Accounts Receivable, Prepaid Deposits, Deferred Revenue should be mapped to their corresponding system accounts.

- Over & Under Payment: If you are using Cash Basis Accounting, it is recommended to create one liability account called Over/Underpayment and map both to that same account. These can also be mapped to their own separate named liability accounts if that is preferred.

-

If you are using Accrual Basis Accounting you would follow the same steps but it is recommended that instead of a liability account you create a revenue account.

-

- Camp Credit: Create and map to a liability account called Camp Credit.

The clip below shows the mapping of the system accounts.gif?width=569&name=ezgif.com-gif-maker%20(17).gif)

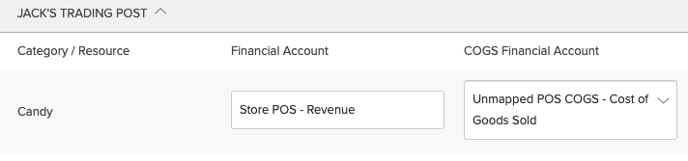

Point of Sale:

- All mapping for the POS is done through Point of Sale > Accounting

-

System Accounts: All system accounts should be mapped to their corresponding system accounts. All corresponding system accounts have 'Unmapped' in the title.

-

Categories: All Categories within your POS Inventory will need to be mapped individually and those should be mapped as described below:

-

Financial Account = General Revenue

-

COGS Financial Account = Unmapped POS COGS

-

Inventory Financial Account = Unmapped POS Inventory

-

Write Off Financial Account = Unmapped POS Write Off

-

Deferred Financial Account = Unmapped POS Deferred Revenue

-

The images below show what the Point Of Sale Accounting page should look like after mapping.

.png?width=200&height=150&name=campspotlogo2019%20(1).png)