Cash Basis vs Accrual Basis Accounting

Learn the differences between Cash Basis and Accrual Basis accounting and how both function in Campspot.

Summary:

Explore the two primary accounting methods, cash basis, and accrual basis, used in Campspot. This article delves into the intricacies of each method, providing examples and explanations. Discover how cash basis payments are applied based on percentages, while accrual basis payments are distributed proportionally over the stay. Exceptions to these rules, involving utility metering, POS charge to site, and miscellaneous charges, add depth to your understanding of Campspot's accounting nuances.

Cash Basis and Accrual Basis Accounting

Explore the primary accounting methods, cash basis, and accrual basis, utilized in Campspot. Tailored financial reports (journal entries) cater to each method, providing insights tailored to your park's chosen accounting style.

In this article, you will find more information on (click on any to skip ahead):

- Cash Basis Accounting

- Accrual Basis Accounting

- Exceptions to these rules: Utility Metering, POS Charge to Site and Miscellaneous Charges

Find out more about Campspot & Accounting by checking out this article:

Defining Cash Basis and Accrual Basis Accounting

Click on either to skip ahead and learn more.

| Cash Basis |

A method of recording accounting transactions for revenue and expenses only when the corresponding asset is received or payments are made. Example: Money received today for a reservation in the future is counted as revenue today. |

| Accrual Basis |

A method of recording accounting transactions for revenue when earned and when expenses are incurred. Example: Money received today for a reservation in the future will be counted as revenue when the reservation takes place. |

Note: For all Journal Entry report examples below only the example transaction is shown on the Journal Entry. In a real scenario most campgrounds will have multiple transactions happening each day and Journal Entries would reflect a summary of the numbers rather than each transaction separately.

Learn more! Check out this article:

How Cash Basis Accounting Works in Campspot

Cash Basis payments in Campspot are applied to invoice items/their corresponding revenue accounts based on percentages.

- If a guest has paid 100% of their reservation, cash basis Journal Entry reports will show each item as fully paid.

- If a guest has not paid 100% of their reservation, the system takes the percentage that they did pay and counts that toward each invoice item.

With cash basis payments being applied in percentages, this may cause you to see numbers on your Journal Entry that are not whole numbers when there are reservations that have not been paid in full.

Note: Many parks that use cash basis accounting require full payment upon booking.

How Accrual Basis Accounting Works in Campspot

Accrual Basis payments in Campspot are applied to invoice items/their corresponding revenue accounts when the reservation starts. Payments are applied proportionally after each day of the stay.

For example, a reservation that is three days long will have 1/3 of the revenue recognized on each day of the stay.

Exceptions To The Rules

Campspot has three categories of additional charges that can be added to an invoice by your park customer service representative after it has been confirmed. These categories are:

- Miscellaneous Charges

- Utility Metering (such as electric metering)

- Charge to Site charges from Point-of-Sale receipts/transactions.

Miscellaneous Charges

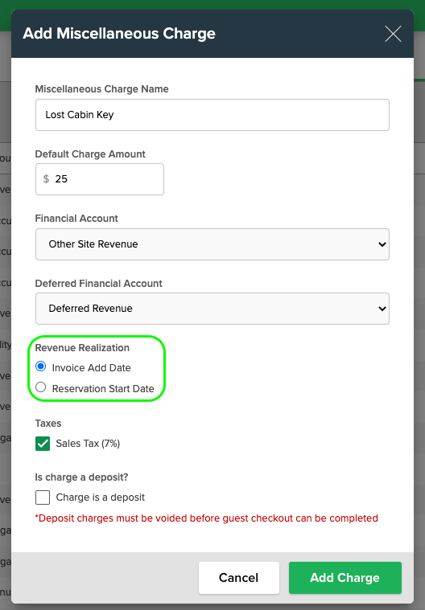

When setting up a Miscellaneous Charge, you have the option to define Revenue Realization as either:

- 'Invoice Add Date' (cash basis)

- 'Reservation Start Date' (accrual-basis)

This choice determines how the charge will be realized.

It's crucial to note that even if your park uses the accrual basis accounting method, you can create Miscellaneous Charges set to be applied using the 'Invoice Add Date.' However, in such cases, those charges will be paid first, and the revenue will be recognized on the date the charge(s) were added to the invoice.

Learn more! Check out this article:

Utility Metering

Campspot typically proportionally applies payments to manual charges on a cash basis; however, utility metering stands out as an exception to this rule.

In the case of utility metering charges, they are prioritized and paid first when a payment is applied. If a utility meter charge is added to a reservation after the most recent payment has been applied, the charge(s) will remain marked as "unpaid" until the next payment is made.

In contrast to standard cash accounting practices, where new charges prompt payment reallocation based on the percentage paid, utility metering charges are treated uniquely by the system. This distinctive approach ensures accurate handling of utility metering transactions within the Campspot platform.

Learn more! Check out this article:

POS Charge to Site Charges

Campspot typically proportionally applies payments to manual charges on a cash basis. However, the POS Charge to Site feature is an exception to this standard rule.

When it comes to Charge to Site charges, they take precedence and are paid first when a payment is applied. If a Charge to Site charge is introduced to a reservation after the most recent payment has been applied, the charge(s) will remain marked as "unpaid" until the next payment occurs.

In contrast to the usual cash accounting practices, where new charges prompt payment reallocation based on the percentage paid, the nature of Charge to Site charges leads the system to treat them uniquely. This distinct handling ensures precision in managing Charge to Site transactions within the Campspot platform.

Learn more! Check out this article:

.png?width=200&height=150&name=campspotlogo2019%20(1).png)