How to: Set up Point of Sale Taxes

Learn how to set up POS taxes including taxes for Miscellaneous Charges.

Summary

Campspot's POS tax creation offers a user-friendly solution to customize and manage taxes for your POS items. From transparent tax names to flexible tax rates, this feature empowers you to enhance the overall POS experience.

Uses

- Customization: Tailor tax names to clearly communicate their purpose on POS receipts.

- Flexibility: Easily switch between flat dollar amounts and percentage-based tax rates.

- Financial Clarity: Streamline accounting by mapping taxes to specific financial accounts.

- Exemption Control: Decide whether taxes can be exempted based on your business requirements.

- Miscellaneous Charges: Ensure accurate tax rates for Miscellaneous Charges by creating dedicated POS tax rates.

Instructions

Create a POS Tax:

- Navigate to Point of Sale

- Click on the Admin tab

- Click on the Taxes tab

- Select Add Tax

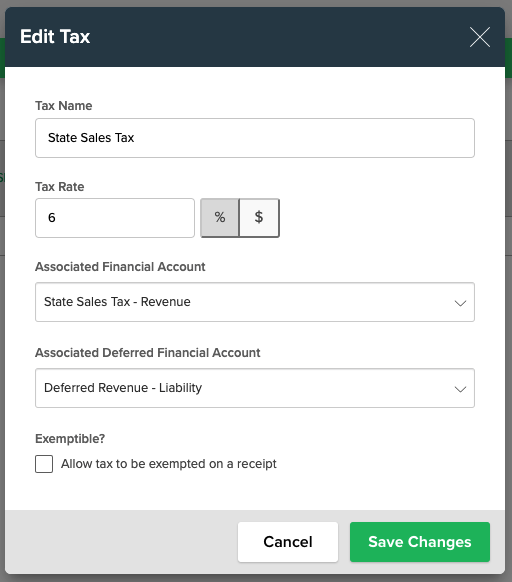

- Complete the New Tax form

Below are notes on the Tax form:

- Tax Name: Guest-facing name appearing on POS receipt. This name should clearly explain what the tax is.

- Tax Rate: Enter the tax rate in the box. The rate can be a flat dollar amount or a percentage of the POS item. Click on the percentage or dollar sign to indicate which.

- Associated Financial Account / Associated Deferred Financial Account: Select the financial account that the tax should be mapped to for accounting purposes. It will reflect on the Journal Entry report when POS items are sold.

- Exemptible?: Select whether you want to allow the tax to be exemptible or not.

Note: Miscellaneous Charges get their tax rate from the set POS tax rate rather than from Reservation Tax Rules. In order to apply taxes to your Miscellaneous Charges, you must create POS tax rates.

Learn more about setting up Miscellaneous Charges here.

.png?width=200&height=150&name=campspotlogo2019%20(1).png)