Utility Taxes: Setup Guide

Learn how to efficiently set up automated Utility Taxes.

Summary

Learn how to effortlessly create and manage utility taxes through Utility Metering in Campspot's Admin Site. Automate calculations and seamlessly add utility taxes to guest bills, enhancing accuracy and efficiency in your billing processes.

Utility Metering Taxes

Leverage the Utility Taxes function to effortlessly apply relevant taxes to two critical components of your billing process:

- Utility Meter Readings

- Utility Fees

With Campspot's flexible system, ensuring accurate tax calculations is a breeze. Follow the steps below to successfully implement these taxes.

Step-by-Step Instructions

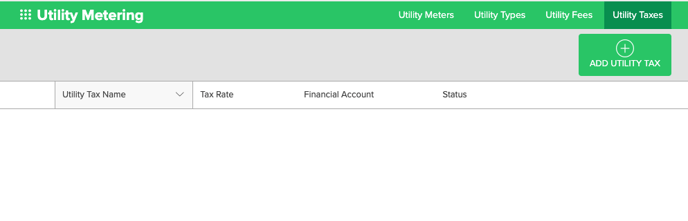

Step 1: Go to Utility Types page

- Navigate to Utility Metering

- Click on Utility Taxes tab

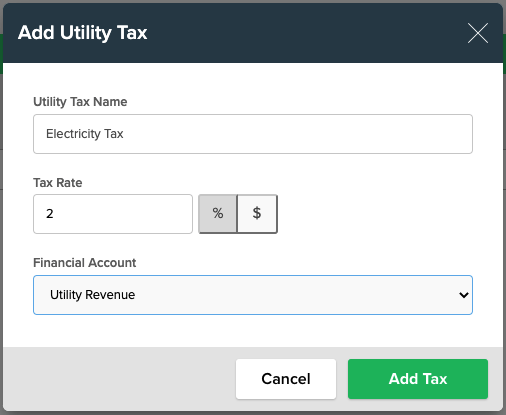

Step 2: Add New Utility Tax

- Click on Add Utility Tax button

- Complete the Utility Tax form

- Click Add Tax to complete process

| Tax Name | Guest-facing name appearing on POS receipt. This name should clearly explain what the tax is. |

| Tax Rate | Enter the tax rate in the box. The rate can be a flat dollar amount or a percentage of the utility bill. Click on the percentage or dollar sign to indicate which. |

| Financial Account | Select the financial account that the tax should be mapped to for accounting purposes. It will reflect on the Journal Entry report when utility fee revenue is earned. |

What if I have taxes that are unique to a Utility Type or Utility Fee?

If your tax structure varies between Utility Types and Utility Fees, don't worry.

Campspot's system allows you to apply taxes to each of these components individually. This flexibility ensures that your tax calculations align with the specific needs of your park, providing a seamless and precise billing experience.

.png?width=200&height=150&name=campspotlogo2019%20(1).png)