Point of Sale Accounting: What's on the page?

Learn where you map POS System Accounts deciding how to report revenue, COGS, inventory, and write-off COGS.

Summary:

Effectively manage your POS financial accounts by configuring system and category accounts. This guide walks you through the Point of Sale Accounting page where you map POS system accounts to define revenue, COGS, inventory, and write-off COGS for seamless accounting integration.

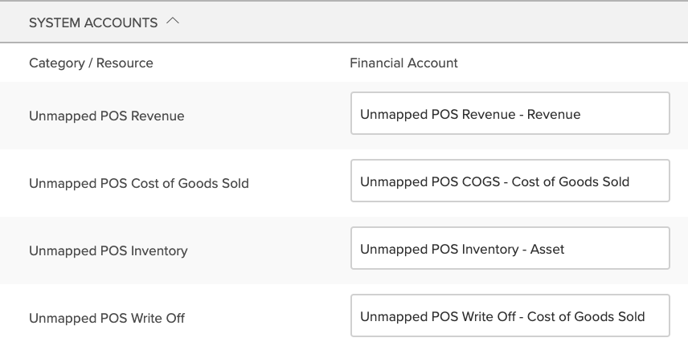

POS System Accounts

System accounts in the point of sale map revenue, cost of goods sold (COGS), inventory, and write-off COGS to specific accounts for unmapped point of sale categories.

When all categories are mapped to custom accounts (more information in the next section of this article), the system accounts are not used.

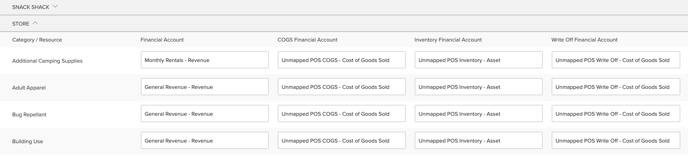

Category Accounts

The financial accounts for point of sale categories are displayed below the system accounts section, organized by location. Clicking on the location name expands and collapses each section.

A category has 4 financial accounts:

| Revenue | Only revenue or liability account types can be mapped to this account. |

| Cost of Goods Sold (COGS) | Only the cost of good sold account type can be mapped here. |

| Inventory | Only the asset account type can be mapped here. |

| Write Off | Only the cost of goods sold account type can be mapped here. |

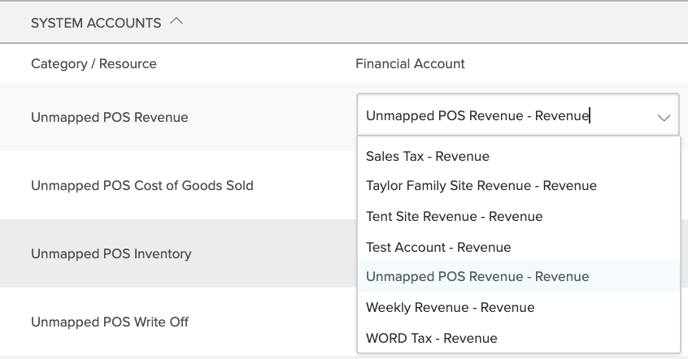

Changing a Financial Account

- Clicking the account field reveals a dropdown menu of all the active financial accounts eligible to be mapped there.

|

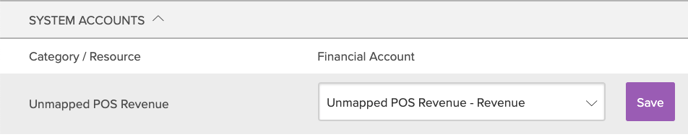

- Select the desired account from the list and then click the Save button.

|

.png?width=200&height=150&name=campspotlogo2019%20(1).png)