Taxes: Rule Setup

Effortlessly manage taxes with Campspot's intuitive setup, ensuring accuracy and transparency in your financial transactions.

Summary

Explore the steps to set up and use the Taxes feature in Campspot, ensuring accurate and efficient tax management for reservations, reservation fees, online booking fees, and more. Follow the comprehensive guide to navigate the Pricing Rules and create distinct tax rules for various scenarios.

New to Tax Setup in Campspot? Check out these articles as well:

Uses

- Tax Customization: Tailor tax rules for different site types, add-ons, and reservation durations to accommodate diverse scenarios.

- Financial Precision: Link taxes to specific financial accounts and deferred financial accounts, ensuring accurate reporting on Journal Entries.

- Transparent Invoicing: Create customer-facing tax names for clear identification on invoices, enhancing transparency in financial transactions.

- Fees for OTA Bookings: Apply fees for bookings made through an OTA and/or Marketplace

Step-by-Step Instructions:

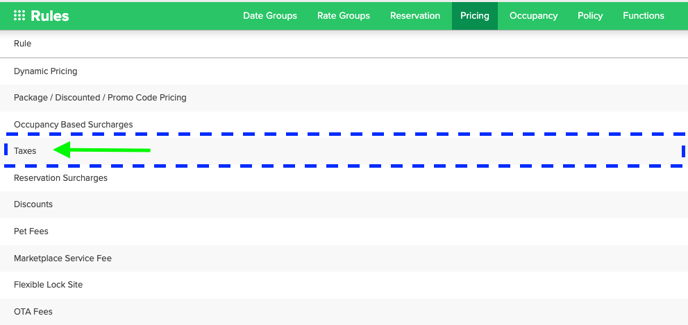

Step 1: Navigate to Pricing Rules

- Using the primary navigation button, click on Rules

- Click on the Pricing tab

- Select Taxes

Step 2: Create New Rule

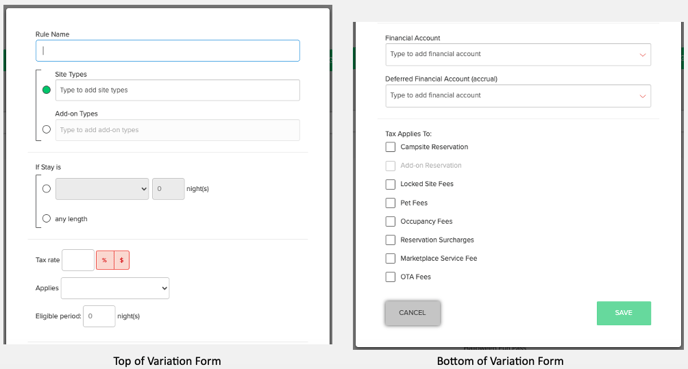

From this page you can either update existing rules or create a new one using the New Variation form. To setup a new rule, follow the directions below:

- Click New Variation

- Complete the form (example of blank below)

- Once complete, click Save

Best Practice:

Create separate tax rules for each tax type for manageable reporting.

New Variation Form Fields

|

Rule Name |

Choose a descriptive name for easy identification. |

|

Site Types/ Add-on Types |

Define which site types or add-ons the rule applies to. Note: You can only select either Site Types or Add On Types for a single rule. |

|

Expiration Date |

Specify when the rule should expire. |

| If Stay is… |

First, select from the drop-down menu one of the following options:

Then, select the number of night(s). |

| Tax Rate |

Enter the tax rate into the field, can enter up to four (4) decimal places. Select if the tax is either a percentage (%) or dollar ($) amount. Note: The tax rate that you charge at your campground should be based on local or state laws. If you have questions, please contact your tax authority. |

| Applies |

Select one of the below options from the drop-down menu:

|

| Eligible Period |

If Flat Rate for Eligible Period or Daily Rate for Eligible Period were selected in the previous step, a number of nights needs to be determined to create the eligible period. |

| Financial Account |

Select the financial account from the drop-down menu in which the taxes will be reflected on the Journal Entry reporting. |

| Deferred Financial Account (Accrual) |

Select the deferred financial account from the drop-down menu in which the taxes will be reflected on the Journal Entry reporting. Even if running on a cash-based accounting system, this drop-down is still required. |

| Tax Applies To |

Select any and all items that are to be taxable on the reservation:

|

Note: If creating a tax rule for add-on type and an add-on type is selected, the Tax Applies To option for Add-on Reservation will be available for selection, for tax rules that are for site types, that option is grayed out.

.png?width=200&height=150&name=campspotlogo2019%20(1).png)