Rules Creation: Pricing > Taxes

On this page of our Rules Creation Video Series, we are learning how to create Pricing rules under Taxes.

Below, you'll find instructional videos that guide you on how to set up pricing rules that are commonly used by parks. These examples are intended to help empower you to create or edit your park's rules.

Creating Rules

To access these Rules go the Rules > Pricing > Taxes

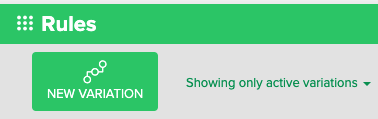

To create a new Rule, click the green New Variation button at the top. After doing that you will see the Rules detail modal where you can create your new rule.

Filling out the Tax Variation

| Rule Name | This will be visible on Receipts and Reports |

| Site Types or Add-Ons | Assign which site types should be applicable for this tax. Based on your unique Local and State Tax Authority, you may need multiple Tax rules for different Site Categories. (For example, some Tax Authorities may require a Lodging Tax, but not a tax on RV sites.) If you have questions, please reach out to your Tax Authority. |

| If Stay is | Assign the number of nights this Tax Rule would apply. |

| Tax Rate | Fill out the percentage or dollar amount of the tax. |

| Applies |

Select whether the rule is a:

|

| Eligible Period |

If the previous selection was for an eligible period, select the number of nights this would apply |

| Financial Account |

Select the Financial Account this rule applies. Click here for more information. |

| Deferred Financial Account |

Select from list. |

| Tax Applies To: |

Select what this Tax Rule would apply to (Campsite or Add-on Reservation, Locked Site Fees, Pet Fees, Occupancy Fees, Reservation Surcharges, Marketplace Service Fee) |

Rule Creation Videos

6% State Lodging Tax For Says Under 90 Days

In the video below we look at the creation of a 6% State Lodging Tax rule for stays that are less than 90 days long. This is a common rule for parks that do not charge tax on longterm stays.

4% State Sales Tax for all reservations

In the video below we look at the creation of a 4% State Sales Tax rule for stays of all lengths. This is one of the most common types of tax rules parks create and the tax rate varies by park location.

.png?width=200&height=150&name=campspotlogo2019%20(1).png)