Reports - Tax Income

This article will show you how to best interpret and use the information provided on the Tax Income report.

Report Summary

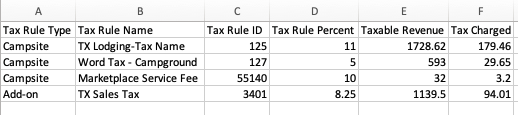

- This report lists your campground's tax rule names, tax percentages, taxable revenue and tax charged for reservation charges occurring over the specified date range. Please note: the tax charged amount is based off of expected revenue before discounts.

- This report is a managerial report and should not be used for financial reporting. The report can help your campground understand at a glance what your taxable revenue is for reservations occurring over the specified date range.

- The total tax charged shown on the report is before any applied discounts. These numbers are based off of what taxes should be. The true amount of tax charged (after any discounts applied to reservations) can be shown on a Journal Entry report and shows the actual amount as charged.

- POS taxes are not included in this report

- This report can only be downloaded in CSV version.

- Below is an image of an example of this report:

Common Report Uses

- View taxable revenue and expected tax income for reservations occurring over the specified date range

Reports to Compare With or Supplemental Reports

- Accrual Basis Journal Entry reports

- Rent Roll (campsites only) to compare total prior tax

Common Report Questions

Q: Why doesn't the total amount of tax charged shown on this report match the amount of tax shown on my Journal Entry?

A: These numbers should not be expected to match for the reasons described below:

- This a dynamic report and unlike a Journal Entry report the numbers are not fixed. As a dynamic report, numbers for the same date range can change day to day based on reservation edits that may have occurred.

- This report shows taxable revenue and tax charged prior to any discounts that may have been applied to reservations. The true amount of tax collected is likely lower as many campgrounds apply discounts to reservations.

- This report shows taxable revenue and taxes on an Accrual Basis meaning the amount is for reservations that occur over the specified date range. If comparing this to a Cash Basis Journal Entry the amounts will never match.

- This report does not include POS tax collected and a Journal Entry report would include that amount if your campground uses the POS and collects taxes on items sold.

Q: Where does the Tax Rule ID come from?

A: This number is system generated and is for internal Campspot use only.

.png?width=200&height=150&name=campspotlogo2019%20(1).png)