Reports - Journal Entry Detail (Cash Basis - By Invoice & Account)

This article will show you how to best interpret and use the information provided on the Journal Entry (Cash Basis - By Invoice & Account) report.

Report Summary

- This report shows all invoices used to generate the cash basis Journal Entry for the specified date range.

- For each invoice on the report, detail is shown by financial account.

- Report totals may differ from the associated Journal Entry by a penny or two as the Journal Entry rounds by account and not by invoice and account.

- This report can be downloaded in CSV version.

- The categories on this report are Park, Invoice #, Reservation Confirmation, Guest First Name, Guest Last Name, Account Type, Financial Account, Financial Account Number, Payment, Charge, Total

- This Journal Entry provides balances and transactions on a cash basis. This means that money is counted as revenue the day that it is received.

- Journal Entry reports contain fixed financial data. This means that if you download the report for yesterday's data today and download it again next week, the data will not change.

- Accounting report data runs every night just after midnight in your park's local time. These reports typically run and are complete around 1am.

Common Report Uses

- Use this report to see the transactions that make up your cash basis Journal Entry for the same date range.

- View categorized revenue accounts and transactions.

- View the breakdown of the charges that a payment went towards on a specific invoice by comparing the Payments vs. Charges account.

Reports to Compare With or Supplemental Reports

- All other Cash Basis Journal Entries

- Total Payments Received or Invoice Payment by Type

Common Report Questions

Q: Can this report be used to find transactions that make up an accrual basis Journal Entry for the same date range?

A: No. This report will only show the transactions that make up the cash basis Journal Entries.

Q: Why are some transactions not showing up as whole dollar amounts even though the charge was a whole dollar amount?

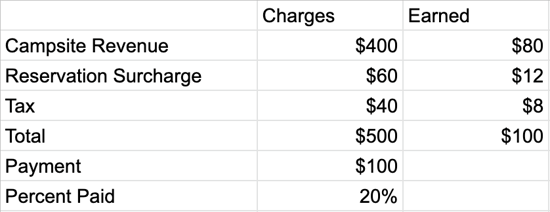

A: In Cash Basis accounting in Campspot, if an invoice was partially paid instead of fully paid, the money paid towards that invoice will be split among all charges on the reservation. For example, if the reservation total is $500 and the deposit is $100, the breakdown of earned revenue for that day be as shown in the image below. These numbers can also be less than whole dollar amounts depending on the number of charges and the amount paid.

Q: What columns on this report should balance with the cash basis Journal Entry?

A: The Charges and Payments columns should balance and should also be equal to the Credit and Debit columns from the Journal Entry.

Note: The total column is the total of both the Charges and Payments totals added together.

Q: What is the difference between a Cash Basis Journal entry and an Accrual Basis Journal Entry?

A: The differences between Cash Basis and Accrual Basis accounting are outlined below:

Cash Basis: A method of recording accounting transactions for revenue and expenses only when the corresponding asset is received or payments are made.

Example: Money received today for a reservation in the future is counted as revenue today.

Accrual Basis: A method of recording accounting transactions for revenue when earned and when expenses are incurred.

Example: Money received today for a reservation in the future will be counted as revenue when the reservation take place.

.png?width=200&height=150&name=campspotlogo2019%20(1).png)