Reports - Journal Entry (Cash Basis - excludes today)

This article will show you how to best interpret and use the information provided on the Journal Entry (Cash Basis - excludes today) report.

Report Summary

- This report creates a Journal Entry to describe the balance of financial accounts across the specified date range.

- This Journal Entry provides balances on a cash basis. This means that money is counted as revenue the day that it is received.

- This report only includes data for days in the past allowing for a faster download.

- Journal Entry reports contain fixed financial data. This means that if you download the report for yesterday's data today and download it again next week, the data will not change.

- Before downloading your Journal Entry, check that your park has some financial account mapping completed as this ensures that the information on your Journal Entry is accurate. If you have custom financial account mapping completed, your Journal Entry will show each account split out with the corresponding revenue listed. For example, when mapping is completed your Journal Entry will show separate lines for Site Revenue earned and for Tax Revenue earned.

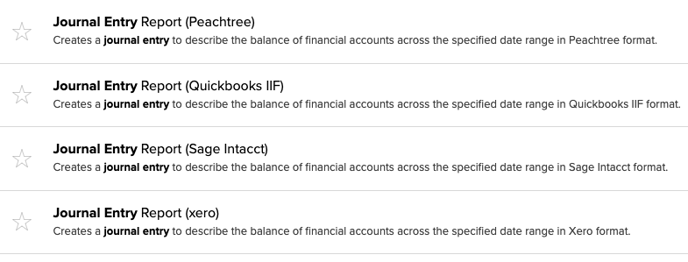

- The Peachtree, Quickbooks IIF, Sage Intacct and Xero reports that are not labeled Accrual contain the same data as the Journal Entry (Cash Basis - excludes today). Below is an image of these reports.

- Accounting report data runs every night just after midnight in your park's local time. These reports typically run and are complete around 1am.

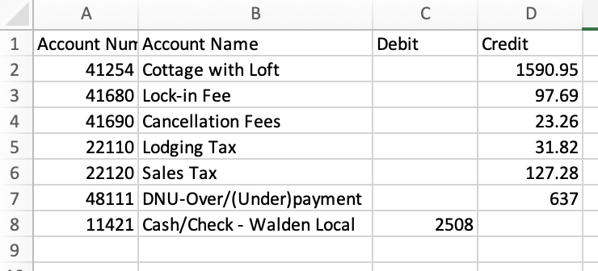

- Below is an image of a Journal Entry (Cash Basis - excludes today) report:

Common Report Uses

- Financial reporting

- View taxable income or taxes collected

- View categorized revenue accounts

- Match report totals with the Total Payments Received report for the same date range to validate earnings

Reports to Compare With or Supplemental Reports

- Journal Entry Construction (Cash Basis)

- Journal Entry Detail (Cash Basis - By Invoice & Account)

- Total Payments Received or Invoice Payment by Type

Common Report Questions

Q: What is the difference between a Cash Basis Journal entry and an Accrual Basis Journal Entry?

A: The differences between Cash Basis and Accrual Basis accounting are outlined below:

Cash Basis: A method of recording accounting transactions for revenue and expenses only when the corresponding asset is received or payments are made.

Example: Money received today for a reservation in the future is counted as revenue today.

Accrual Basis: A method of recording accounting transactions for revenue when earned and when expenses are incurred.

Example: Money received today for a reservation in the future will be counted as revenue when the reservation take place.

Q: Why is my Journal Entry only showing a few of my accounts and not splitting out all the different revenue streams in Campspot?

A: Your Journal Entry may not show all of your revenue accounts if you have not yet completed any financial account mapping. Financial Account Mapping involves your park creating financial accounts in Campspot in order to match the way that you currently categorize and report revenue. Once these accounts are created, each corresponding item in Campspot should be mapped to the correct account. We have two articles to help you learn more about financial account mapping:

Re-mapping Default Financial Accounts

If you have completed some financial account mapping and do not see all of your accounts showing on your Journal Entry report, it may be because there was no activity for items mapped to those accounts over the specified date range. Only accounts that have had activity over the specified date range will show on the Journal Entry.

Q: How can I find out what transactions make up the numbers I am seeing on this Journal Entry?

A: The Journal Entry Detail (Cash Basis - By invoice & Account) report shows all invoices used to generate the cash basis Journal Entry for the specified date range. With this report, you can filter to show only certain accounts and locate the specific transactions you are seeking.

Note: Report totals may differ (by a penny or two) between the detail and non-detail versions as the Journal Entry rounds by account and not invoice and account.

Q: Why do certain charges in my revenue accounts not add up evenly to the number of charges I had during the reporting period?

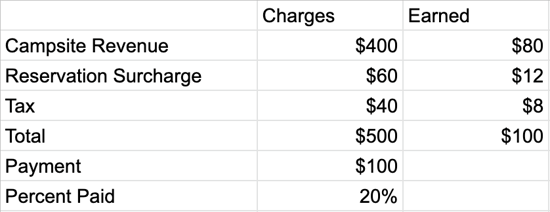

A: Partially paid invoices require all charges present on the reservation to be partially paid as well. For example, if the reservation total is $500 and the deposit is $100, the breakdown of earned revenue for that day be the following...

Q: Why doesn't the amount for tax revenue match the amount on the Tax Income Report for the same date range?

A: These two reports are providing data for two different sets of reservations even though the date range may be the same and with that in mind, these should not be expected to match. The Journal Entry (Cash Basis - Excludes Today) shows data for everything that was paid for over the specified date range while the Tax Income report shows data for all reservations that occur over the specified date range. Many reservations are booked and paid for outside of the date range that they occur therefore these numbers would not match.

Q: If I make an edit to a past invoice will it change numbers on the Journal Entry for that day?

A: No. The data on all Journal Entries is fixed for financial reporting purposes. Changes or edits made to past invoices will not affect past Journal Entries. Changes are only reflected on the Journal Entry for the day that the change occurs.

.png?width=200&height=150&name=campspotlogo2019%20(1).png)