Reports - Journal Entry (Accrual Basis Detailed with Inventory)

This article will show you how to best interpret and use the information provided on the Journal Entry (Accrual Basis Detailed with Inventory) report.

Report Summary

- This report creates a Journal Entry to describe the balance of financial accounts across the specified date range.

- This Journal Entry provides balances on an accrual basis. This means that money is counted as revenue when that reservation begins even if payment was received prior to reservation start date.

- This report can only be downloaded in CSV version.

- Journal Entry reports contain fixed financial data. This means that if you download the report for yesterday's data today and download it again next week, the data will not change.

- Before downloading your Journal Entry, check that your park has some financial account mapping completed as this ensures that the information on your Journal Entry is accurate. If you have custom financial account mapping completed, your Journal Entry will show each account split out with the corresponding revenue listed. For example, when mapping is completed your Journal Entry will show separate lines for Site Revenue earned and for Tax Revenue earned.

- There are Peachtree, Quickbooks IIF, Sage Intacct, Yardi and Xero reports that contain this same information but are formatted specifically for those accounting softwares.

- Accounting report data runs every night just after midnight in your park's local time. These reports typically run and are complete around 1am.

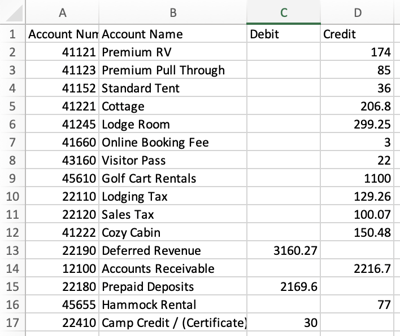

- Below is an image of a snippet of the Journal Entry (Accrual Basis Detailed with Inventory) report:

Common Report Uses

- Financial reporting

- View taxable income or taxes collected

- View categorized revenue accounts

Reports to Compare With or Supplemental Reports

- Liability Detailed Report

- Audit Trail

- Trial Balance

Frequently asked questions

Q: What is the difference between an Accrual Basis Journal entry and a Cash Basis Journal Entry?

The differences between Accrual Basis and Cash Basis accounting are outlined below:

- Accrual Basis: A method of recording accounting transactions for revenue when earned and when expenses are incurred.

- Example: Money received today for a reservation in the future will be counted as revenue when the reservation take place.

- Cash Basis: A method of recording accounting transactions for revenue and expenses only when the corresponding asset is received or payments are made.

- Example: Money received today for a reservation in the future is counted as revenue today.

Q: What is the difference between a report with inventory and without inventory?

The reports with inventory contain data on any Inventory POS accounts. These accounts can have the account type of Asset or Cost of Good Sold. The 'without inventory' reports does not include the inventory accounts. Inventory Accounts that typically have the COGS account type are Unmapped POS Write Off, Unmapped POS COGS and any other COGS accounts that your park creates to track cost.

If your park does not use the POS feature in Campspot you can look at Journal Entries without inventory.

Q: Why is my Journal Entry only showing a few of my accounts and not splitting out all the different revenue streams in Campspot?

Your Journal Entry may not show all of your revenue accounts if you have not yet completed any financial account mapping. Financial Account Mapping involves your park creating financial accounts in Campspot in order to match the way that you currently categorize and report revenue. Once these accounts are created, each corresponding item in Campspot should be mapped to the correct account.

If you have completed some financial account mapping and do not see all of your accounts showing on your Journal Entry report, it may be because there was no activity for items mapped to those accounts over the specified date range. Only accounts that have had activity over the specified date range will show on the Journal Entry.

Q: How can I find out what transactions make up the numbers I am seeing on this Journal Entry?

The Audit Trail Report (Reporting Service) and Liability Detailed Report (Reporting Service) can be used together to validate each account. These reports will recognize revenue based on the dates of guest's stay, and not necessarily when their reservation was paid. The Audit Trail report will include all accounts except Deferred Revenue, Prepaid Deposits and Accounts Receivable. Those three accounts can be found on the Liability Detailed Report (Reporting Service). shows all invoices used to generate the cash basis Journal Entry for the specified date range. With both of these reports, you can filter to show only certain accounts and locate the specific transactions you are seeking.

Q: Why don't the numbers in my Journal Entry match with the numbers in the Audit Trail?

The first step in troubleshooting numbers that don't match on these two reports is to make sure that you have completed some financial account mapping. If your accounts are not correctly mapped, you will not see accurate numbers on these reports. We have two articles to help you learn more about financial account mapping:

If you have completed financial account mapping and are still unsure about the numbers on your Journal Entry and Audit Trail not matching, you should also consider that the Audit Trail Report (Reporting Service) will include all accounts except Deferred Revenue, Prepaid Deposits and Accounts Receivable. These accounts can be found on the Liability Detailed Report (Reporting Service). To validate the numbers on your Journal Entry you should use both the Audit Trail Report (Reporting Service) and Liability Detailed Report (Reporting Service).

Q: How can I find out which items could contribute a certain account I see on my journal entry?

To see what items may be contributing to a certain account on your Journal Entry you can use the reports mentioned above and you can also look at your Financial Account Mappings report to get a full list of where each item in Campspot is mapped. For example, you may see a large number on your Journal Entry under the General Asset account and from your Financial Account Mappings report you can see which items may contribute to that account.

Q: Why do certain charges in my revenue accounts not add up evenly to the number of charges I had during the reporting period?

Revenue is earned daily according to how a charge is split up on the reservation invoice. For example, if you charge a $2 reservation surcharge and this charge is applied as a "flat rate for all days" the $2 charge will pro-rated across all days of the reservation. As a result, only a portion of that $2 charge will be earned each day of the reservation. The same concept applies for daily, package and stay length based rates.

Q: Does marking a reservation as a no show have any impact on my Accrual Journal Entry?

The no show status will only remove the reservation from the Front Desk Arrivals and Who's In The Park lists and it will not have any bearing on financials. Your Journal Entry will only be impacted when edits are made to the reservation invoice.

.png?width=200&height=150&name=campspotlogo2019%20(1).png)