Reports - Audit Trail (Reporting Service)

This article will show you how to best interpret and use the information provided on the Audit Trail report.

Report Summary

- This report creates an audit trail report showing all invoice charges and payments that make up the accrual basis journal entry for the specified date range.

- This report includes all accounts except for Deferred Revenue, Prepaid Deposits and Accounts Receivable. Those accounts can be found on the Liability Detailed Report (Reporting Service) report.

- Changes made to financial account mapping are retroactive and will show past data categorized in the updated way after mapping changes have been made.

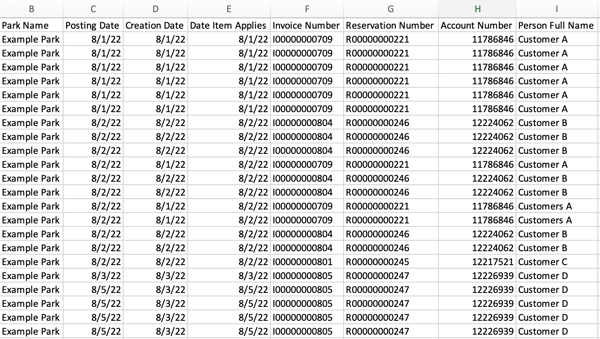

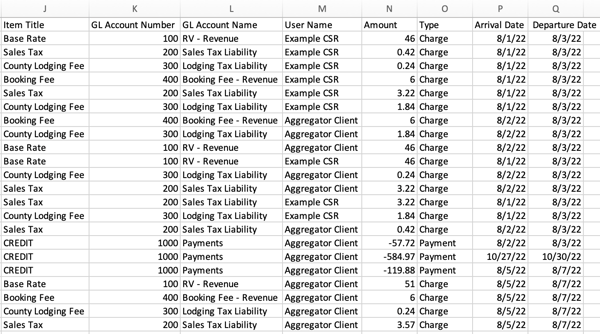

- The categories included on this report are Park Name, Posting Date, Creation Date, Date Item Applies, Invoice Number, Reservation Number, Account Number, Person Full Name, Item Title, GL Account Number, GL Account Name, User Name, Amount, Type, Arrival Date and Departure Date

- As the Audit Trail report typically contains a very large amount data you may experience downloads times of 15 minutes and up.

- This report can only be downloaded in CSV version. Note: due to the large amount of data provided on the Audit Trail it is recommended that you us the the filter and sort feature or pivot tables as you review the data.

Common Report Uses

- Find the details of all transactions that make up the numbers shown for each account on an accrual basis Journal Entry.

- For Accrual Basis Journal Entries, the Audit Trail report can be used together with the Liability Detailed Report to validate each account shown on the Journal Entry. The Audit Trail report would be used to validate all accounts apart from Deferred Revenue, Prepaid Deposits and Accounts Receivable as those are found on the Liability Detailed report.

Reports to Compare With or Supplemental Reports

- Liability Detailed Report (Reporting Service)

- Trial Balance (this is a summary of the Audit Trail)

- All accrual basis Journal Entry reports

Common Report Questions

Q: If I change my financial account mapping how long will that take to reflect on the Audit Trail?

A: All changes made to account mappings should reflect on the Audit Trail within one day.

Q: Why aren't all accounts from the accrual basis Journal Entry showing up on the Audit Trail?

A: To figure out why accounts are not showing on the Audit Trail, first check that the accounts you're looking for are not Deferred Revenue, Prepaid Deposits or Accounts Receivable. Next, confirm if any changes have been made to your financial account mapping between the time you ran the Journal Entry report and the Audit Trail report. If changes have been made in that time, the old accounts may no longer reflect on the Audit Trail report as the changes are retroactive.

.png?width=200&height=150&name=campspotlogo2019%20(1).png)