Journal Entry Basics

Learn more about managing Journal Entries in Campspot.

Summary:

Demystify the complexities of journal entries in Campspot with this comprehensive guide. Learn how to access, select, and validate the right reports based on your park's accounting method. Ensure data accuracy through account mapping and gain insights into supplemental reports for both Cash Basis and Accrual Basis transactions.

Understanding Journal Entries in Campspot

Journal entries serve as comprehensive records of your park's financial transactions over a specific period. These entries are typically stored in an accounting journal, which can be exported as a .csv file in Campspot. Within these records, transactions are listed, displaying both debit and credit balances.

Use this article to find more details on:

- Accessing Journal Entry Reports

- Determining the Right Report

- Accounting Software Compatibility

- Generating Accurate Data: Account Mapping

- Validating Your Journal Entries by Accounting Type

Accessing Journal Entry Reports

-

Navigate to Reporting: From the primary navigation, select Reporting.

-

Search for Journal Entry Reports: Enter Journal Entry in the search field.

-

Download Reports: Select the desired report, set the date range, and click "Download."

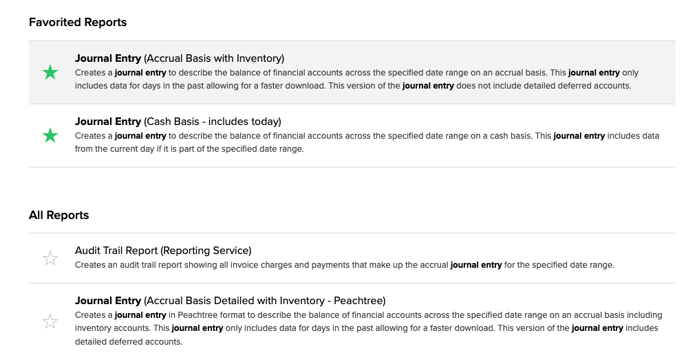

Tip: Make frequently used reports easily accessible by favoriting them. Simply click the star icon next to the report title to add it to your favorites list.

Determining the Right Report

The type of journal entry you utilize depends on your park's accounting method: Cash Basis or Accrual Basis.

Learn more! Check out the link below:

Accounting Software Compatibility

Campspot offers various versions of journal entry reports compatible with different accounting software, such as:

- Peachtree

- Quickbooks (IIF for the desktop version of QB)

- Xero

- Intacct

- Sage Intacct

- Yardi

Choose the version that aligns with your accounting platform for seamless integration.

Take Your Financial Accounting to the next level!

Campspot integrates with some of the most popular Accounting software, including Quickbooks Online, Sage Intacct, Netsuite, and more.

Click here to learn more about Accounting Software Integration.

Generating Accurate Data: Account Mapping

Ensure the accuracy of journal entry data by mapping accounts correctly within Campspot. Custom Financial Account Mapping or re-mapping default Financial Accounts can be performed based on your park's requirements.

Learn more! Check out these articles:

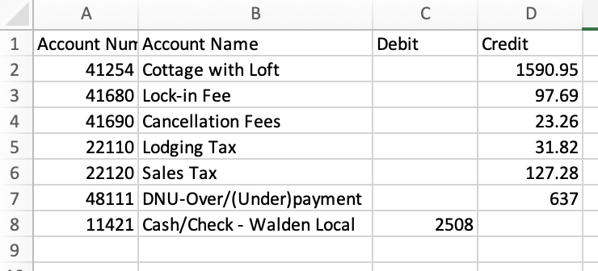

The image below shows a Cash Basis Journal Entry report after Custom Financial Account Mapping has been completed. All Accounts shown were created by the park in order to match what exists in their accounting software.

Validating Your Journal Entries

To validate and track your park's revenue, there are recommended supplemental reports you can use as outlined below.

Cash Basis:

For Cash Basis Journal Entries, use the following reports:

- Journal Entry Construction (Cash Basis): This report offers a detailed breakdown of Cash Basis Journal Entries, providing insights into how each entry was constructed.

- Journal Entry Detail (Cash Basis - By Invoice & Account): Similar to the Construction report, this provides a comprehensive breakdown by invoice and account, offering clarity on each transaction.

Understanding Cash Basis Reports:

-

Cash Basis reports recognize revenue on the same day it's paid, irrespective of reservation dates.

-

The Invoice Payment by Type and Total Payments Received reports align with Cash Journal Entries.

-

These reports are commonly utilized for end-of-day register balancing or payment verification rather than revenue analysis.

Accrual Basis:

For Accrual Basis Journal Entries, use the following reports:

- Validation Reports: The Accrual Basis Journal Entries are verified using the Liability Detailed Report and Audit Trail.

- Revenue Recognition: These reports acknowledge revenue based on the dates of the guest's stay, rather than when reservations were paid.

- Trial Balance Summary: The Trial Balance report serves as a condensed overview of the Audit Trail.

- Account Inclusions: The Audit Trail encompasses all accounts except Deferred Revenue, Prepaid Deposits, and Accounts Receivable. These accounts are detailed in the Liability Detailed Report.

.png?width=200&height=150&name=campspotlogo2019%20(1).png)