How To: Reverse a Payment or Refund

Navigating Financial Precision: Correcting Payments and Refunds on Invoices.

Summary:

Discover the corrective steps to manage mistaken payments or refunds on an invoice effectively. This guide outlines the process for both scenarios, ensuring accurate financial transactions.

Uses:

- Correct payments taken in the wrong amount, method, or on the incorrect reservation.

- Rectify refunds issued with incorrect details, such as amount, method, or guest association.

Correcting a Payment

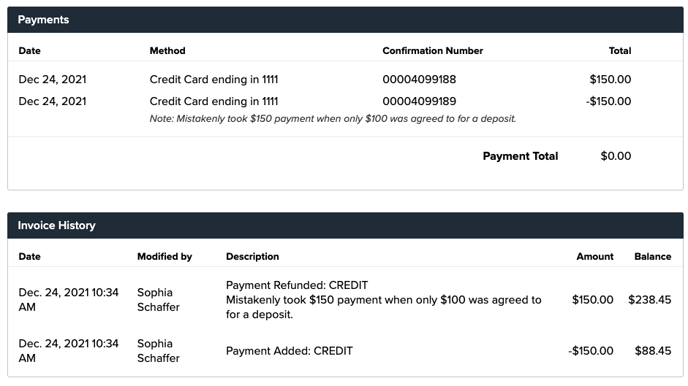

When a payment is taken in the incorrect amount, payment method or on the incorrect reservation or guest, it can be corrected by completing a refund in the same amount with the same method.

Example: a payment that was taken as a Credit Card payment for $100 cannot be reversed, but a refund can be issued back to the card for $100.

Step-by-Step Guide:

- Navigate to the invoice with the mistaken payment in the Billing tab of the Reservation.

- Click "Refund" at the top of the Billing tab.

- Select "Other Amount" and enter the same amount as the mistaken payment. Ensure the refund method matches the original payment method.

- Click "Continue."

- If you don't want the guest to receive an email notification, uncheck the "Send Email Confirmation To Guest" box.

- Click "Submit Payment."

Issuing a refund in the same amount and method will restore the invoice to its prior state, allowing you to initiate a payment with the correct details.

Best Practice:

Include notes for internal auditing when correcting payments and refunds.

The image below shows the Payments and Invoice History sections of an invoice with a mistaken payment corrected by issuing a refund in the same amount.

Correcting a Refund

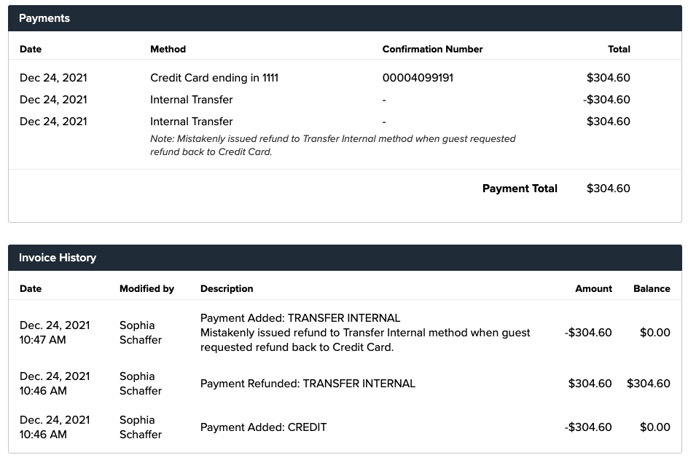

When a refund is given in the incorrect amount, method or on the incorrect reservation or guest, it can be corrected by completing a payment in the same amount with the same method.

Example: a refund that was issued with the Transfer External payment method for $100 cannot be reversed, but a payment can be added on to the reservation for $100.

Step-by-Step Guide:

- Navigate to the invoice with the mistaken payment in the Billing tab of the Reservation.

- Click "Pay" at the top of the Billing tab.

- Select "Other Amount" and enter the same amount as the mistaken payment. Ensure the refund method matches the original payment method.

- Click "Continue."

- If you don't want the guest to receive an email notification, uncheck the "Send Email Confirmation To Guest" box.

- Click "Submit Payment."

Adding a payment in the same amount and method will return the invoice to its previous state, allowing you to issue a refund with the correct details.

Best Practice:

Include notes for internal auditing when correcting payments and refunds.

The image below shows the Payments and Invoice History sections of an invoice with a mistaken refunded corrected by adding a payment back in the same amount.

Most Common FAQ:

Q: Can a payment or refund be entirely reversed?

No, but you can correct them by issuing a refund for a payment or adding a payment for a refund.

Q: Why is it important to include notes when correcting transactions?

Notes aid in internal auditing, providing clarity on the reasons behind corrective transactions.

Q: What should I do if a payment or refund was issued with the wrong method?

Correct it by issuing a refund or payment with the correct method, ensuring accuracy in financial records.

Q: Can I avoid notifying the guest when correcting a payment or refund?

Yes, uncheck the "Send Email Confirmation To Guest" box during the corrective transaction.

Q: How does correcting a refund affect the invoice balance?

Adding a payment in the same amount will return the invoice to its state before the mistaken refund.

Q: Is there a recommended practice for correcting payments and refunds?

Always include notes explaining the reason for corrective transactions to facilitate internal auditing.

.png?width=200&height=150&name=campspotlogo2019%20(1).png)