Custom Financial Accounts: Setup Guide

Learn how to effectively set up custom financial accounts to meet your Financial reporting preferences.

Summary:

Financial account mapping in Campspot is vital for organizing assets, liabilities, and revenue to ensure accurate financial reporting. This guide outlines the process of creating custom accounts. By following these steps, you can effectively manage the way you want your park's financial performance reporting, customized to meet your specific requirements.

Uses:

-

Customize Accounts: Tailor financial management for detailed financial reporting.

-

Utilize Mapping: Identify items for mapping.

-

Ensure Consistency: Align with accounting software.

-

Avoid Conflicts: Prevent duplicate IDs.

Learn more! Click the resource below:

Creating Custom Financial Accounts

For a more detailed approach to financial reporting, users can create custom Financial Accounts beyond the 11 default ones implemented during onboarding (more information on those found here).

Tip: Utilize the Financial Account Mappings report to identify items within Campspot that can be mapped, aiding in the decision-making process for creating new accounts.

Follow the step-by-step instruction provided below to customize your Financial Accounts:

Step-by-Step Instructions:

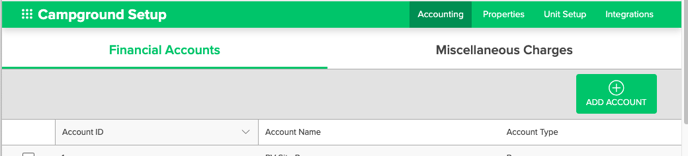

Step 1: Find the Financial Accounts page

- Navigating to Campground Setup

- Select the Accounting tab

- Click on Financial Accounts

Step 2: Add New Financial Account

- Click Add Account

- Complete Add Account form

- Finalize by clicking Add Account

.gif?width=475&height=429&name=ezgif.com-gif-maker%20(90).gif)

|

Account ID |

Apply a unique ID for easy identification of the account. (please see note below) |

|

Account Name |

Provide a descriptive account name. |

|

Account Type |

Identify account as either: Asset, Revenue, Liability, Expense, Cost of Goods Sold |

Please Note:

As a best practice, ensure consistency between the information provided here and the corresponding entries in your accounting software (usually identified by your Chart of Accounts).

This alignment is crucial, especially if you intend to utilize any accounting software-specific Journal Entry reports.

If your accounting software lacks Account IDs, you have the flexibility to assign numbers as per your preference within Campspot.

Financial Account Types

Campspot has four basic types of financial accounts. Once a financial account is created the account type cannot be changed.

|

Asset |

Assets and Asset Accounts represent the account of record for Cash, Check, Credit Cards, and other valuables provided by guests to the park in exchange for goods and services. This account type is also utilized for Transfer Internal, Transfer External, and POS inventory accounts. |

|

Revenue |

Revenue and Revenue Accounts serve as the account of record for charges or fees earned by the park for providing goods and services to guests. |

|

Liability |

Liabilities and Liability Accounts represent the account of record for potential obligations by the park to another entity, such as a guest or a tax authority. |

|

Cost of Goods Sold |

When the sale of a POS item occurs, Campspot debits the cost associated with the item from the designated COGS Financial Account. |

.png?width=200&height=150&name=campspotlogo2019%20(1).png)