Campspot Accounting: General FAQ & Troubleshooting

Learn about the most common questions with answers on Campspot Accounting along with some troubleshooting.

Summary:

This FAQ guide addresses common questions related to Campspot's financial processes. From troubleshooting deposit discrepancies to understanding revenue reports, it provides clarity on mapping financial accounts, taxable revenue visibility, handling long-term and short-term stays, and reconciling payment-related reports. Whether you're dealing with internal transfers, updating credit card batch times, or navigating accrual and cash basis accounting, this guide has got you covered.

Most Common FAQ:

Quickly find answers to questions related to the topics below:

- Deposits on Fiserv (formerly Clover/CardConnect)

- Revenue/Occupancy reports do not match Revenue on Journal Entry reporting

- Viewing Taxable Income

- Mapping Financial Accounts if you have long and short term bookings

- Total Payments received vs Revenue

- Transfer Internal on Invoice Payment by Type Report

- Update Card Connect Batch Time

- Accrual Basis

- Cash Basis

General Questions

Q: My deposit from Fiserv (formerly Clover/CardConnect) does not match the asset account on my Journal Entry (JE) for the same day. Why?

Troubleshoot this by:

-

Start here: Review financial account mappings. Are your credit card deposits mapped to the same account as any other payment methods?

-

Are they mapped to the same place as other payments?

-

Yes, they are mapped to the same Financial Accounts.

If they are mapped to same place and you accepted other payments that day, the deposit amounts will not match Fiserv reports.

-

Solution: 1. You will want to re-map your financial accounts or 2. reference the Total Payments Received report to reconcile deposits. See screenshots below for examples of each:

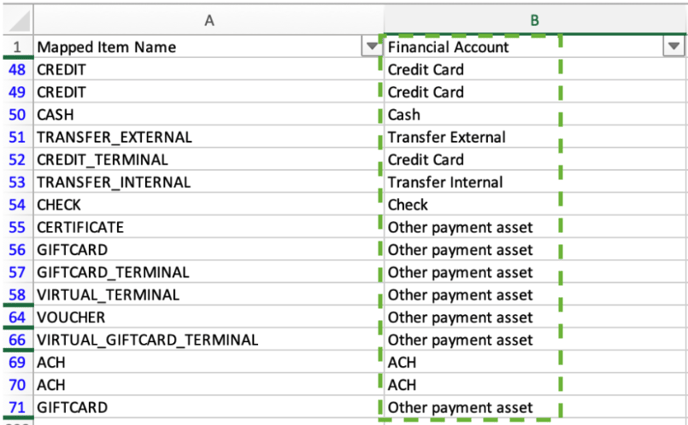

1. Payments are mapped to Financial Accounts based on type of payment.

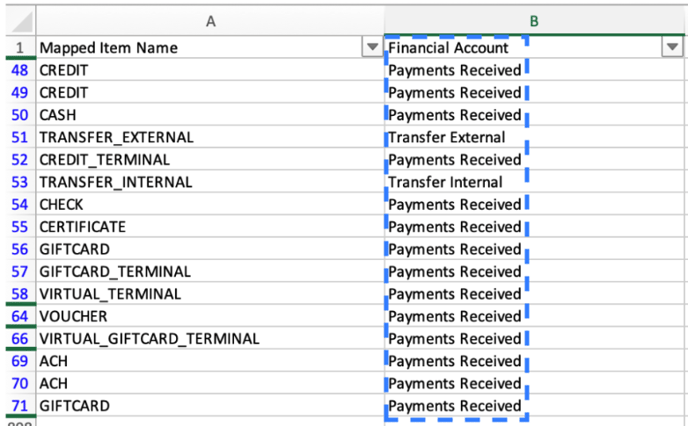

2. All Payments mapped to single Financial Account - reference Total Payments Received report to reconcile.

-

-

No, they are not mapped to the same Financial Accounts.

If credit card asset is mapped separately and not matching, review the Fiserv batch time as the account may be batching early.

-

Learn more about Re-mapping Accounts.

Q: Why do the various Revenue & Occupancy Reports not match revenue on my JE

Any of the Revenue and Occupancy reports are managerial reports, while Campspot's Journal Entries are financial reports.

- Managerial reports: give a snapshot of the campsite revenue and can be used for things like determining top performing site types, a general overview of revenue, and making business decisions. Managerial reports will dynamically update for changes that happen later (Example: I cancel a booking that was supposed to arrive last week. If a managerial report is ran again for that same time period, the cancellation will be reported.)

Examples: Rent Roll (Campsites Only), Rent Roll (Add-ons Only) and Rent Roll (Reporting Service)

- Financial reports: give an accurate overview of all financial activities over the given time period. Financial reports take into account activity like site edits and cancellations, which can impact various revenue accounts on the JE. Financial reports should be used for taxes and determining exact revenue. (Example: I cancel a booking that was supposed to arrive last week. A financial report will not reflect the cancellation last week, but rather for today as the date of cancellation.)

Q: How do I see my taxable revenue?

View your taxable revenue on the:

- Journal Entry (Accrual Basis with Inventory) Reports

- Journal Entry (Cash Basis Excludes Today) Reports

Best Practices:

- Verify your Financial accounts are mapped based on your accounting practices before using JEs.

- Only use the journal entry reports to report taxable revenue.

- What about the Tax Income report?

- The tax income report provides an estimate, but does not take into account things like discounts applied to reservations, so it tends to over-report taxable revenue. This report also does not include POS taxes.

- This report should not be used to report on taxes.

- What about the Tax Rule report?

- This report will only show the tax collected and not the taxable revenue. This report can be utilized if they just need to see tax collected.

- What about the Tax Income report?

Q: I have both long-term and short-term stays on the same site type. Can I still map my monthly revenue to a different account than my daily revenue?

Yes!

- Site types as a whole can be mapped under Campground Setup > Unit Setup.

- If you want to have the revenue from specific packages mapped separately, remap those under Reporting > Accounting.

Click to learn more about the Accounting tab in Reports.

Q: Why does my Total Payments Received report not calculate an accurate reflection of revenue?

Depending on your type of liabilities, receiving a payment may not be the same as generating revenue. Your accounting basis (cash or accrual) will impact how payments are reflected as income. Other financial accounts that may impact this are taxable vs. non-taxable revenue, liability accounts for taxes, etc.

Q: What is the difference between the Total Payments Received report and Revenue Summary by Site report?

- Total Payments Received report: Pulls data based on any transactions that occur during the date range pulled, meaning it is showing all payments that were processed over that time frame.

This report also includes payments for things that are not accounted for in the Revenue Summary by Site report, such as POS transactions or utility meter readings.

- Revenue Summary by Site report: Based on revenue for reservations that occur over the date range pulled.

Since a reservation that takes place in this time frame could have had a payment either before or after those dates, the two reports will not line up.

Q: Why does TRANSFER_INTERNAL show up on the Invoice Payment by Type report?

Internal transfer payments will report on the Invoice Payment by Type report to record where funds have moved within the system.

The most common things reasons are:

- Money moving between the guest’s customer profile and reservation

- Money moving between user and camp credit

-

POS transactions being charged to site

The sum of all of the 'Internal Transfer' payments on the Invoice Payment by Type report should equal $0.

A quick way to spot check this is to run the Total Payments Received report. This report should not have anything listed for Transfer Internal.

Q: How do I update my credit card batching time in Card Connect?

If your reports for total payments do not match batch totals, you may need to update your batch time. Click here to learn more.

Accrual Basis Questions

View the most common questions and answer for Accrual Basis Accounting in Campspot here.Cash Basis Questions

View the most common questions and answer for Accrual Basis Accounting in Campspot here.

.png?width=200&height=150&name=campspotlogo2019%20(1).png)