Campspot Accounting: Cash Basis FAQ & Troubleshooting

Learn about Cash Basis Accounting in Campspot with Q&A and the top troubleshooting tactics.

Summary:

Demystify Cash Basis Accounting in Campspot, while gaining a clearer understanding and practical insights. You will learn how the system handles fully paid, partially paid, and edited invoices. Real-world examples illustrate the nuances of cash basis transactions, empowering users to navigate and troubleshoot scenarios effectively. The content also addresses common questions, ensuring readers grasp the fundamentals and application of Cash Basis Accounting in the Campspot environment.

How does Cash Basis Accounting work with invoices?

Fully Paid Invoices

If a guest has paid 100% of their reservation, cash basis Journal Entry reports will show each item as fully paid.

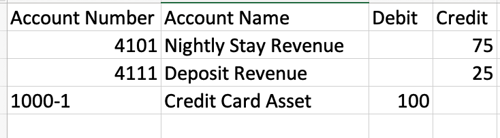

Example: The invoice total is $100.00 and consists of $75 for a nightly stay and $25 for a deposit. The guest has currently paid $100.00. A Journal Entry report would show the following:

-

- $75 credit to the revenue account corresponding with the nightly stay

- $25 credit to the revenue account corresponding with the deposit

- $100 debit to the designated asset account

The image below shows what this one example would have looked like on a cash basis Journal Entry report:

Partially Paid Invoices

If an invoice has not been paid in full, the system takes the percentage that was paid and allocates that percentage toward each invoice item/account.

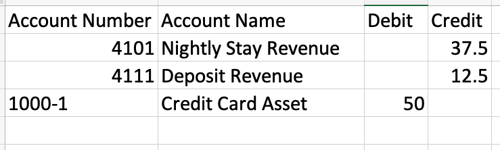

Example: The invoice total is $100.00 and consists of $75 for a nightly stay and $25 for a deposit. The guest has currently paid $50.00 (50%). Instead of $50.00 being applied to the highest charge first, Campspot splits the $50 among each charge. A Journal Entry report would show the following:

-

- $37.50 credit (50% of $75.00) to the revenue account corresponding with the nightly stay

- $12.50 credit (50% of the $25.00) to the revenue account corresponding with the deposit.

- $50 debit to the corresponding payment asset account

The image below shows what this one example would have looked like on a cash basis Journal Entry report:

Edited Invoices

If an invoice has been paid in full and then additional charges are added to it and are not paid for when added (causing the invoice to no longer be paid in full) Campspot will reallocate money to the corresponding revenue accounts based on the percentage of the new total paid.

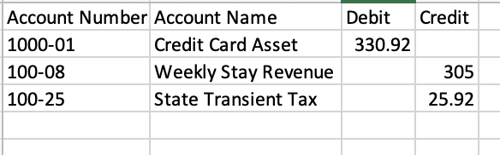

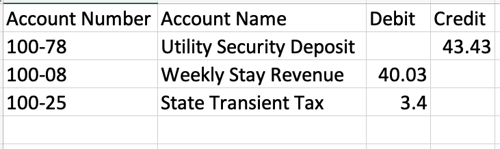

Example: The invoice total is $330.92 and consists of $305 for a weekly stay and $25.92 for taxes. The guest has currently paid the full $330.92. A week after the day the guest originally booked the reservation (also before the reservation arrival date), a $50 charge for a utility deposit is added to the reservation but is not paid for at that time.

This then causes the invoice to be paid only 86.8% given the new total and the total amount paid to date. In this case, cash basis accounting in Campspot splits the paid $330.92 (86.8%) among each invoice item so that they are each partially paid. 86.8% of the total payment will now be applied to each invoice item, including the new $50 charge. A Journal Entry report viewed on the day that the $50 charge was added would show following:

-

- $40.03 debit (13.2% of $305.00) from the revenue account corresponding with the weekly stay

- $3.40 debit(13.2% of $25.92) from the revenue account corresponding with the taxes

- $43.43 credit (86.8% of $50.00) to the revenue account corresponding with the utility deposit

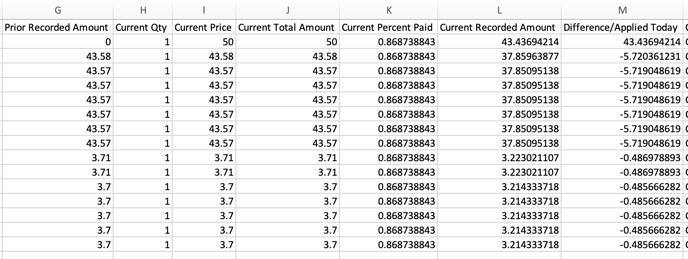

The images below show what this example would have looked like on a Journal Entry. The first image is for the first transaction and the second image is on a later date after the $50 charge was added.

This reallocation of money that takes place is important to note because it may be shown on a Journal Entry Construction (Cash Basis) as negative numbers. This happens when money is moved from one financial account to another based on the way that cash basis accounting splits the total paid. In this case, seeing a negative number does not indicate that a refund took place but rather that money was moved between accounts.

The image below shows a snippet of what the above example would look like on the Journal Entry Construction (Cash Basis). Please note that because this is for a 7 day reservation, the amounts moved between accounts are listed by day rather than for the 7 day total.

Questions & Answers

Q: I charge a booking fee of $2.00. Why are the fees showing as $0.40 on my Journal Entry Detail report?

If the reservation has not been paid on full, Campspot will allocate a portion of the payment the guest made in advance to each charge on their invoice.

To troubleshoot this:

- Confirm that a partial payment had been made on the reservation during the time frame the report was run for. If the balance was paid in full later, the remaining revenue would be recognized on that later JE.

.png?width=200&height=150&name=campspotlogo2019%20(1).png)