Campspot Accounting: Accrual Basis FAQ & Troubleshooting

Learn about Accrual Basis Accounting in Campspot with Q&A and the top troubleshooting tactics.

Summary:

This guide provides an in-depth look at Accrual Basis Accounting in Campspot, accompanied by common questions and troubleshooting tactics. Key concepts unique to Accrual Basis journal entries include Accounts Receivable, Deferred Revenue, and Prepaid Deposits.

Accrual Basis Accounting

Below are account concepts that are unique to Accrual Basis journal entries:

| Accounts Receivable | The total value of the reservation that is to be recognized once the reservation has concluded, regardless of what was paid at the time of booking. |

| Deferred Revenue | The revenue expected from the guest for the future stay, regardless of what was paid at the time of booking. |

| Prepaid Deposits | The value of the asset (payment) that was received towards the future stay. |

How does Accrual Basis Accounting work with invoices?

Fully Paid Invoices

If an invoice has been paid in full, multiple transactions will show on the Journal Entry report that will indicate your campground received full payment.

Example: A guest makes a seven-night cabin reservation today with an arrival date a month from now. The invoice total is $1007.00. This includes $700.00 for cabin revenue, $250.00 for golf cart revenue, and a $57.00 sales tax liability.

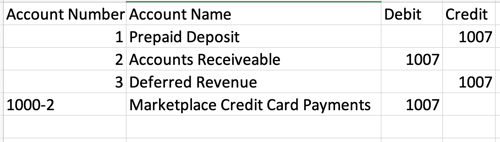

The guest has currently paid the full $1007.00. An accrual basis Journal Entry report for the day the reservation was made would show the following:

- $1007.00 debit to the corresponding payment asset account

- $1007.00 credit to the prepaid deposit liability account

- $1007.00 debit to the accounts receivable asset account

- $1007.00 credit to the deferred revenue account

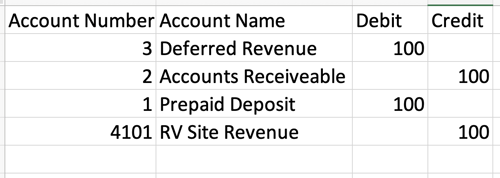

The image below shows what only this transaction would look like on an accrual basis Journal Entry report:

Note: If the campground uses separate deferred revenue accounts for the cabin, golf cart rental and sales tax they would see the money broken out into separate deferred revenue accounts on a detailed Journal Entry report.

As the reservation takes place, Campspot would record proportional partial payment for each night of the reservation.

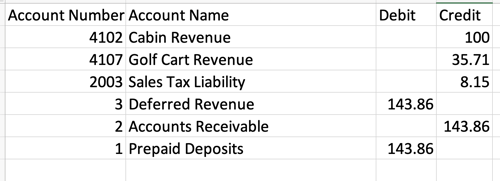

Example: 1st Night

- $143.86 (1/7 of $1007.00) debit to the prepaid deposit liability account

- $143.86 (1/7 of $1007.00) credit to the accounts receivable asset account

- $100.00 (1/7 of $700.00) credit to the cabin revenue account

- $35.71 (1/7 of $250.00) credit to the golf cart revenue account

- $8.15 (1/7 $57.00) credit to the sales tax liability account

- $143.86 (1/7 of $1007.00) debit to the deferred revenue account

The image below shows what only this transaction would look like on an accrual basis Journal Entry report:

For each subsequent night of the reservation the same transactions would take place and show on the Journal Entry report for that date. The only difference would be the tax amount would decrease by one penny on 3rd-7th nights in order for the amount to round out correctly. By the end of the the stay the campground would have $1007.00 in assets recorded for the $950.00 of revenue earned and for the $57.00 collected for tax liability.

Partially Paid Invoices

If an invoice has not been paid in full, multiple transactions will show on the Journal Entry report that will indicate that your campground received partial payment and is also is owed money for the reservation.

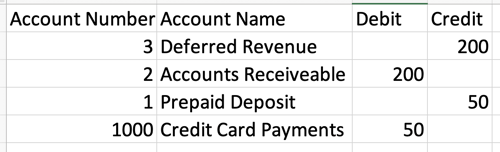

Example: A guest makes a two-night reservation today with an arrival date a month from now. The invoice total is $200.00 for the two nights. The guest has currently paid $50.00. An accrual basis Journal Entry report for the day the reservation was made would show the following:

- $50.00 debit to the corresponding payment asset account

- $50.00 credit to the prepaid deposit liability account

- $200.00 debit to the accounts receivable asset account

- $200.00 credit to the deferred revenue account

The image below shows what only this transaction would look like on an accrual basis Journal Entry report:

Assuming the guest pays the remaining balance of $150.00 at the time of check in, the payment asset account used will be debited by $150.00, the prepaid deposit liability account would be credited by $150.00 and the accounts receivable and deferred revenue accounts would remain unchanged. This would display on the Journal Entry report for the day of payment.

As the reservation takes place, Campspot would record proportional partial payment for each night of the reservation.

Example: 1st Night

- $100.00 debit to the prepaid deposit liability account

- $100.00 credit to the accounts receivable asset account

- $100.00 credit to the corresponding payment asset account

- $100.00 debit to the deferred revenue account

The image below shows what only this transaction would look like on an accrual basis Journal Entry report:

For the second night of the reservation the same transactions would take place and show on the Journal Entry report for that date. By the end of the the stay the campground would have $200.00 in assets recorded for the $200.00 revenue earned from the reservation.

Most Common Questions & Answers

Q: What is Accounts Receivable?

The total value of the reservation that is to be recognized once the reservation has concluded, regardless of what is paid at the time of booking.

Q: What is Deferred Revenue?

The revenue expected from the guest for the future stay, regardless of what was paid at the time of booking.

Q: What is a Prepaid Deposit?

The value of the asset (payment) that was received towards the future stay.

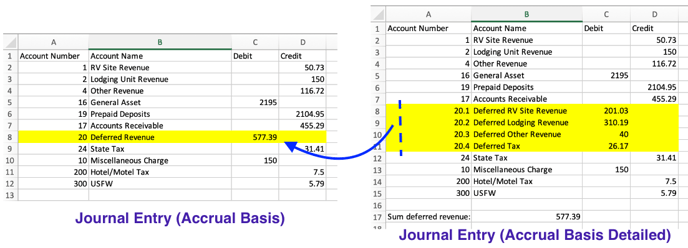

Q: What is the difference between the Journal Entry (Accrual Basis Detailed) and Journal Entry (Accrual Basis)?

- Journal Entry (Accrual Basis Detailed): The detailed version of the JE will break down all deferred revenue (DR) into the park’s custom deferred accounts. You will see multiple line items for DR.

- Journal Entry (Accrual Basis): The non-detailed version couples all DR into the system “Deferred Revenue” account so you will only see one line item for DR.

- The Sum of DR accounts on the detailed report should match the DR number for the non-detailed report when run for the same date range.

- Q: My DR accounts do not match between the two reports?

Review the Financial Account Mappings report to verify if any mapped item is not mapped to the correct custom DR accounts.

- Q: My DR accounts do not match between the two reports?

Q: I don’t think my deferred revenue, prepaid deposits, or accounts receivable is accurate on my Journal Entry. What can I do?

Step 1: Verify your system accounts are mapped properly.

Step 2: Validate the values by using the Liability Report.

- Select a report date range to audit (for example: 02/01 - 02/28)

- Download the Journal Entry (Accrual Basis with inventory) report for that date range. (for example: 02/01 - 02/28)

- Download 2 versions of the Liability Detailed Report

- Version 1: Use the day before the date range selected. (for example: 01/31)

- Version 2: Use the last day of the selected reporting date range (for example: 02/28)

- Filter the column, Column L Row Type to only show accounts labeled "Summary"

- Starting with Deferred Revenue (DR), subtract the sum of the DR columns on the Liability Detailed Reports from one another (Version 2 - Version 1). This amount should match the DR amount on the Journal Entry Report.

- Repeat Step 5 for prepaid deposits and accounts receivable.

Q: I tried to validate the JE with the Liability reports, but they do not match. What do I do?

- Verify the correct Liability Report has been downloaded.

- Make sure to use the "Detailed" version, not the "Summary" version.

- Two versions of this report are used:

- Version 1: Using the day before the reporting date range.

- Version 2: Using the last day of the reporting date range.

- Two versions of this report are used:

- Make sure to use the "Detailed" version, not the "Summary" version.

- On the downloaded excel document, verify that you have filtered Column L (Row Type). If done correctly, you will filter down to just the accounts labeled "Summary".

- Verify the Financial Account Mappings report to audit your system accounts are mapped to your accounting practices.

.png?width=200&height=150&name=campspotlogo2019%20(1).png)