Financial Mapping: Using the Accounting tab in Reports

Learn more using the Accounting tab within Campspot Reporting to view and edit financial accounts

Summary:

Efficient financial management is essential for campground operations, and Campspot's Accounting tab offers a centralized solution. This tool empowers users to configure system accounts and customize financial accounts for Site Types and Default System Accounts, ensuring accurate reporting and informed decision-making.

New to Financial Account Mapping? Start with this article:

Reporting: Accounting tab

Whether you're mapping default system accounts or creating custom ones, the Accounting tab provides the flexibility and precision needed to ensure accurate reporting and informed decision-making. Let's dive in and explore how this powerful tool can streamline your financial processes and optimize your campground's performance.

This feature offers quick access to the following:

Locating to the Accounting tab:

- Navigate to Reporting.

- Clicking on the Accounting Tab.

System Accounts

Your System Accounts serve as your default accounts for Financial Accounts set up throughout Campspot. These accounts include:

| System Account | Use |

| Accounts Receivable |

Outstanding customer balances for provided goods or services, tracking unpaid charges until settled. |

| Prepaid Deposits |

Funds received in advance for future reservations or services, awaiting utilization or fulfillment. |

| Deferred Revenue |

Denotes revenue received in advance for services or goods not yet delivered, awaiting recognition upon fulfillment. |

| Overpayment |

Used to track User Credits. User Credit is available to be refunded to a guest or used on a future reservation. Learn more about User Credit here. |

| Underpayment |

The value of unpaid charges on an invoice after the reservation departure date has elapsed. |

| Camp Credit |

Camp Credit is only able to be used on future reservations, not intended to be refunded to your guest. Learn more about Camp Credit here. |

Learn more! Check out this resource:

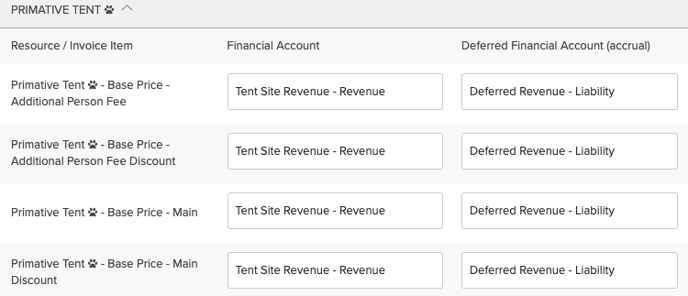

Site Type Financial Accounts

When setting up Site Types, you assign financial accounts to various elements, including:

- Main Financial Account

- Main Discount Financial Account

- Additional Person Fee Financial Account

- Additional Person Fee Discount Financial Account

- Corresponding Deferred revenue accounts (Accrual Basis Accounting)

These accounts serve as default categories for site revenue, defining how revenue is reported on performance reports.

Please Note:

As a best practice, make sure your Financial Reporting strategy in Campspot aligns with your Accounting practices. If using an Accounting software (i.e. Quickbooks), you may have access to a Chart of Accounts. As you explore Campspot's Financial Account customization options, ensure you keep your Chart of Accounts handy.

Custom Financial Accounts

As part of your financial reporting practices, you may want Site Type revenue to report separately. For example:

- Site Type Revenue by Site Category (i.e. RV site revenue, Lodging Revenue, Tent Revenue, etc.)

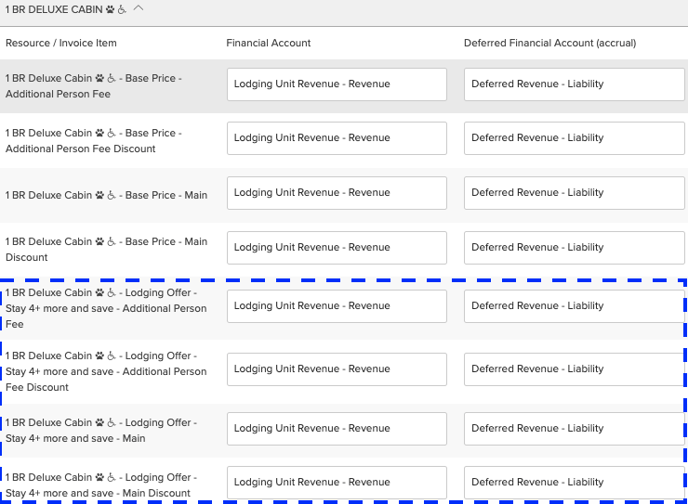

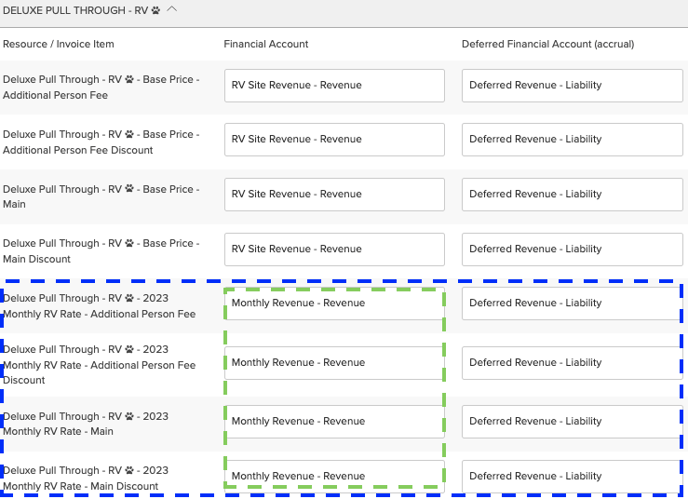

- Package Pricing (i.e. "Stay 4, Save 15%" package, Weekly rates, Monthly or Annual RV extended stay rates)

To achieve this, you can create custom Financial Accounts and apply them to Site Types, fees, rules, etc., enabling flexible and accurate reporting.

The Reporting Accounting tab enables you to quickly update Site Type and Daily Add-on financial accounts, including any active packages in one location.

Mapping Custom Accounts

For a better understanding of using of the Accounting tab to map Site Type custom accounts, let's take a look at the examples provided previously:

Example 1: If your financial reporting preference is to track Site Type performance by Site Category, you can either:

- Update each Site Type within Unit Setup (recommended)

- Use the Accounting tab to define each Financial Account by Site Type (as seen in the screenshot below)

Example 2: If your reporting preference is to show Site Type performance by packages, leverage the Accounting tab to update each package and corresponding Financial Accounts to preferred custom accounts.

See the screenshots below as an example:

- Stay 4, Save 15%

- Extended Stay Rate Package

Learn more! Check out these links to learn more:

.png?width=200&height=150&name=campspotlogo2019%20(1).png)