Accounting Language Definitions

Find definitions of accounting related language and concepts used by Campspot.

Summary:

This comprehensive guide provides definitions and insights into common accounting terms within the Campspot software. From Debit and Credit explanations to nuanced definitions of Asset, Revenue, and Liability Accounts, it's a valuable resource for understanding financial transactions. The article also delves into specific concepts like Cash Basis and Accrual Basis Accounting, Deferred Revenue, Prepaid Deposit, and various types of Credits.

Debit and Credit Definitions

In accounting, understanding Debit and Credit is fundamental. In simple terms, Debit is like adding to your account (assets or expenses), while Credit is like subtracting or owing (liabilities or equity).

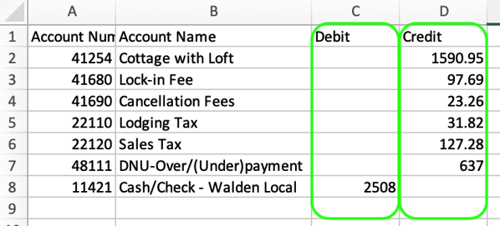

When accounting for these transactions in on of Campspot's Journal Entry reports, you will find the amounts listed in two accounts, where the debit column is on the left and the credit column is on the right.

System and Reservation Definitions

| Cash basis accounting |

Imagine only counting money when it's in your hand. That's cash basis accounting. If you get paid today for a future reservation, we consider it income right away. |

| Accrual basis accounting |

Now, picture counting money when you earn it, not when you receive it. That's accrual basis accounting. If you get paid today for a future reservation, we wait until the reservation happens to count it as income. |

Learn more here: Cash Basis vs Accrual Basis Accounting. |

|

| Asset Account |

For Campspot, assets are like valuable things guests give, such as cash, checks, or credit cards. This account also covers transfers and inventory. This account type would also be used for Transfer Internal, Transfer External and POS inventory accounts. |

| Revenue Account |

This is where we track money earned by the park for services provided to guests. |

| Liability Account |

For Campspot purposes, think of this as potential IOUs. It's what the park owes to others, like guests or tax authorities. |

| Accounts Receivable |

For Campspot Purposes, Accounts Receivable refers the total value of the reservation to be recognized once the reservation has concluded. This is recorded as an asset account. Similar to Deferred Revenue, the entire value of a reservation is debited to Accounts Receivable upon booking, regardless of how much payment has been collected for that reservation. |

| Deferred Revenue |

Deferred Revenue is revenue expected from a customer for future goods or services. The seller records this revenue as a liability, because it has not yet been earned. In Campspot, the entire value of a reservation is credited to Deferred Revenue upon booking, regardless of how much payment has been collected for that reservation. |

| Prepaid Deposit |

For Campspot purposes, Prepaid Deposits can be defined as the value of an asset (such as a credit card payment) that has been received toward a future obligation, such as a reservation. This is recorded as a liability account. |

| Overpayment |

Assets applied and recorded that exceed the invoice balance. |

| Underpayment |

The value of unpaid charges on an invoice after the reservation departure date has passed. |

| Camp Credit |

Value of liability for the park for guests to use solely for in-park purchases or future stays. These funds are non-refundable. |

| User Credit |

Funds available on a Guest's profile that are available for future use. These funds are eligible for a refund through the Guest Profile. |

Learn more here: Camp Credit Versus User Credit. |

|

| Financial Account |

Any cash-basis asset, liability, or revenue account either created by default in Campspot or created by a user. |

| Deferred Financial Account (accrual) |

Any accrual-basis liability account either created by default in Campspot or created by a user. |

Point of Sale Accounting Related Definitions

| Financial Account | POS item revenue account. POS is always cash basis as the sales are only recorded on the date they occur. |

| Cost of Goods Sold (COGS) Financial Account | When the sale of a POS item occurs, Campspot will debit the cost associated with the item from the designated COGS Financial Account. |

| Inventory Financial Account | When the sale of a POS item occurs, Campspot will credit the designated Inventory Financial Account for an amount equal to the COGS transaction. |

| Unmapped POS Revenue | A default system account/placeholder that is used to record revenue for POS sales that do not have a designated Financial Account. |

| Unmapped POS Cost of Goods Sold | A default system account/placeholder for the COGS financial account. |

| Unmapped POS Inventory | A default system account/placeholder for the Inventory Financial Account. |

| Unmapped POS Write-Off |

A default system account/placeholder for the COGS Write-Off financial account. |

.png?width=200&height=150&name=campspotlogo2019%20(1).png)